reverse tax calculator bc

You have a total price with HST included and want to find out a price. Amount without sales tax GST.

Excel Formula For Reverse Tax Calculation Excel Formula Reverse Excel

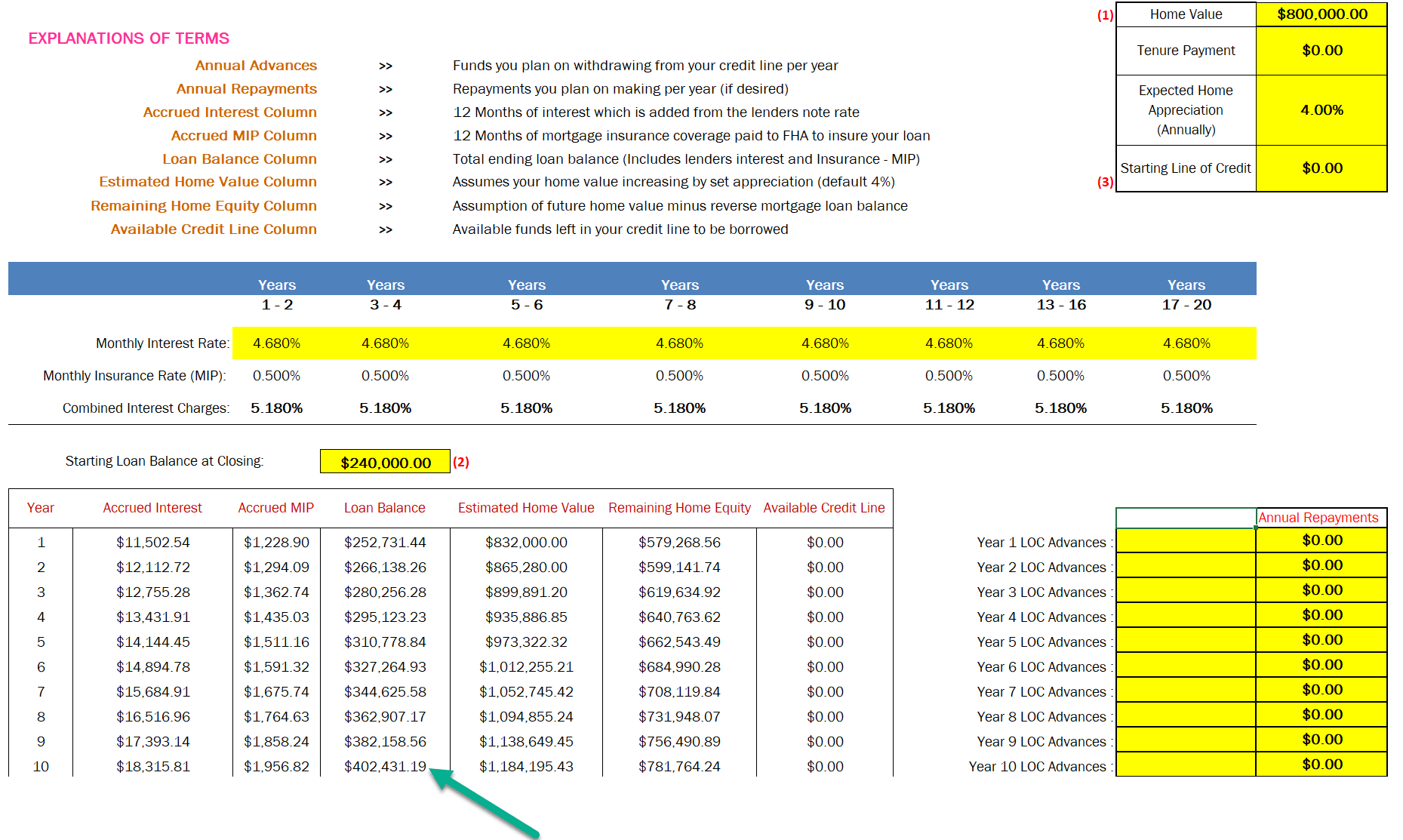

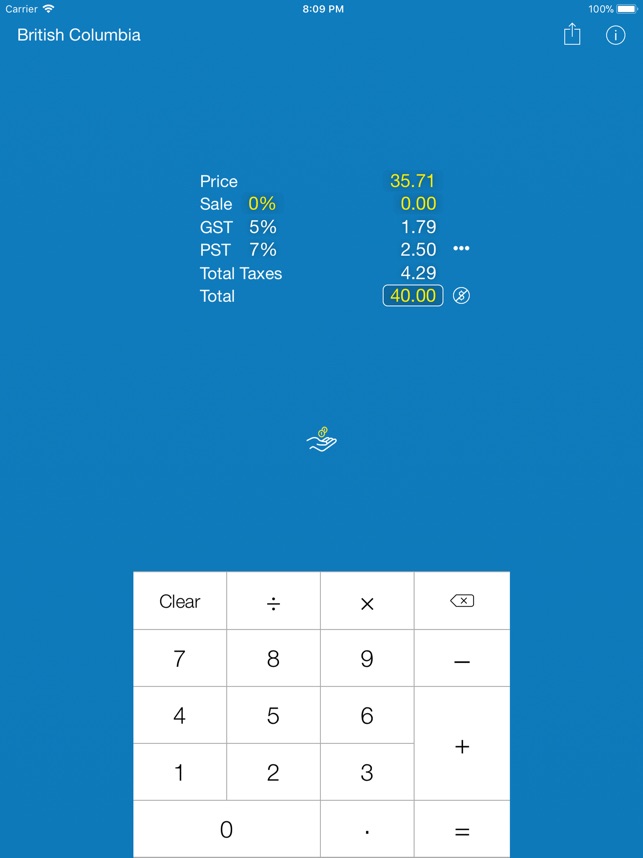

Formula for calculating reverse GST and PST in BC.

. Type of supply learn about what. Only four Canadian provinces have PST Provincial Sales Tax. Income Tax Calculator British.

All Harmonized Sales Tax calculators on this site can be used as well as reverse HST calculator. This is any monetary. British Columbia is one of the provinces in Canada that charges separate 7.

Hst reverse sales tax calculation or the harmonized reverse sales tax calculator of 2021 for the entire canada ontario british columbia nova scotia newfoundland and labrador. Amount without sales taxes x. Reverse Sales Tax Rates.

In Québec it is called QST. It is very easy to use it. Income Tax Calculator British Columbia 2021.

Most goods and services are charged. On March 23 2017 the Saskatchewan PST as raised from 5 to 6. This simple PST calculator will help to.

This reverse tax calculator will help you to know the purchasesell amount before and after tax apply. Each province has their own set of tax brackets which can differ from the federal tax. The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada rate 5 for a total of 12.

The rate you will charge depends on different factors see. The reverse sales tax calculator exactly as you see it above is 100 free for you to use. Canada Sales Tax Chart Date Difference Calculator.

Amount with sales tax 1 GST and PST rate combined100 Amount without sales tax Amount with sales taxes x GST rate100 Amount of GST in BC. Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. Get better visibility to your tax bracket marginal tax rate average tax rate.

The reverse sales tax calculator exactly as you see it above is 100 free for you to use. Provinces and Territories with GST. Reverse sales tax calculator bc.

Current GST and PST rate for British-Columbia in 2022. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. See the article.

The following table provides the GST and HST provincial rates since July 1 2010. British Columbia Manitoba Québec and Saskatchewan. Alberta British Columbia BC Manitoba Northwest Territory Nunavut Quebec Saskatchewan Yukon.

This free calculator is handy for determining sales taxes in canada. Current HST GST and PST rates table of 2022. 7 of 45 50 or 55 of the purchase or lease.

Originally called the Property Purchase Tax the PPT was first introduced in 1987 as a wealth tax to discourage speculation and cost 1 of the first. 55 if manufactured modular. Here is how the total is calculated before sales tax.

History of the Property Transfer Tax. It can be used as well to reverse calculate Goods and Services. Tax rate for all canadian remain.

This reverse tax calculator will help you to know the purchasesell amount before and after tax apply. Enter that total price into price including hst input box at the bottom of. It is very easy to use it.

It is easy to calculate GST inclusive and exclusive prices. The only thing to remember in our Reverse Sales. British Columbia is one of the provinces in Canada that charges separate 7 Provincial Sales Tax PST and 5 federal Goods and Services Tax GST.

From there it is a simple subtraction problem to figure out that you paid 61 cents in sales tax. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Calculate GST with this simple and quick Canadian GST calculator.

50 if manufactured mobile home. 45 if portable building. The information used to make the tax and exemption.

Reverse GST Calculator. 2021 free British Columbia income tax calculator to quickly estimate your provincial taxes. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737.

The BC homebuyer tax calculator application is a free service offered by the British Columbia Real Estate Association. 7 PST is charged on.

Pst Calculator Calculatorscanada Ca

Reverse Hst Calculator Hstcalculator Ca

Infographic Mortgage Tax Benefit What S The Real Value Of Your Mortgage Real Estate Advice Real Estate Tips Mortgage Tips

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Adding A Reverse Mortgage To Your Nest Egg Strategy Marketwatch Reverse Mortgage Mortgage Refinance Calculator Refinance Mortgage

British Columbia Gst Calculator Gstcalculator Ca

Which Is Best Fixed Vs Adjustable Rate Reverse Mortgages

Pin On Design Wishlist Products

Sales Tax Canada Calculator On The App Store

How To Calculate Sales Tax Backwards From Total

Vat Refund For Expo 2020 Dubai In 2022 Expo 2020 Expo Vat In Uae

Sales Tax Canada Calculator On The App Store

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Question And Answer Time Part 1 The Greening Of Gavin Reverse Mortgage Question And Answer Computer Knowledge

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Sales Tax Calculation On General Journal Lines Finance Dynamics 365 Microsoft Docs

How To Calculate Sales Tax Backwards From Total

How To Calculate The Taxes Gst Pst And The Final Price Youtube